The past 12 months saw 35 new ETFs being launched and 2 ETFs closing down. As of March 2022, there were 266 ETFs on the ASX and Cboe Australia. One of the most noticeable trends was the large growth in thematic ETFs.

Thematic ETFs are constructed to invest in particular investment themes or sectors. In our 2021 report, we found that thematic ETFs grew by over 400%, and we continue to see a strong appetite from the ETF issuers to launch these products. For example, thematic ETFs in the areas of hydrogen, cryptocurrency, electric vehicles and semiconductors were all launched over the past year.

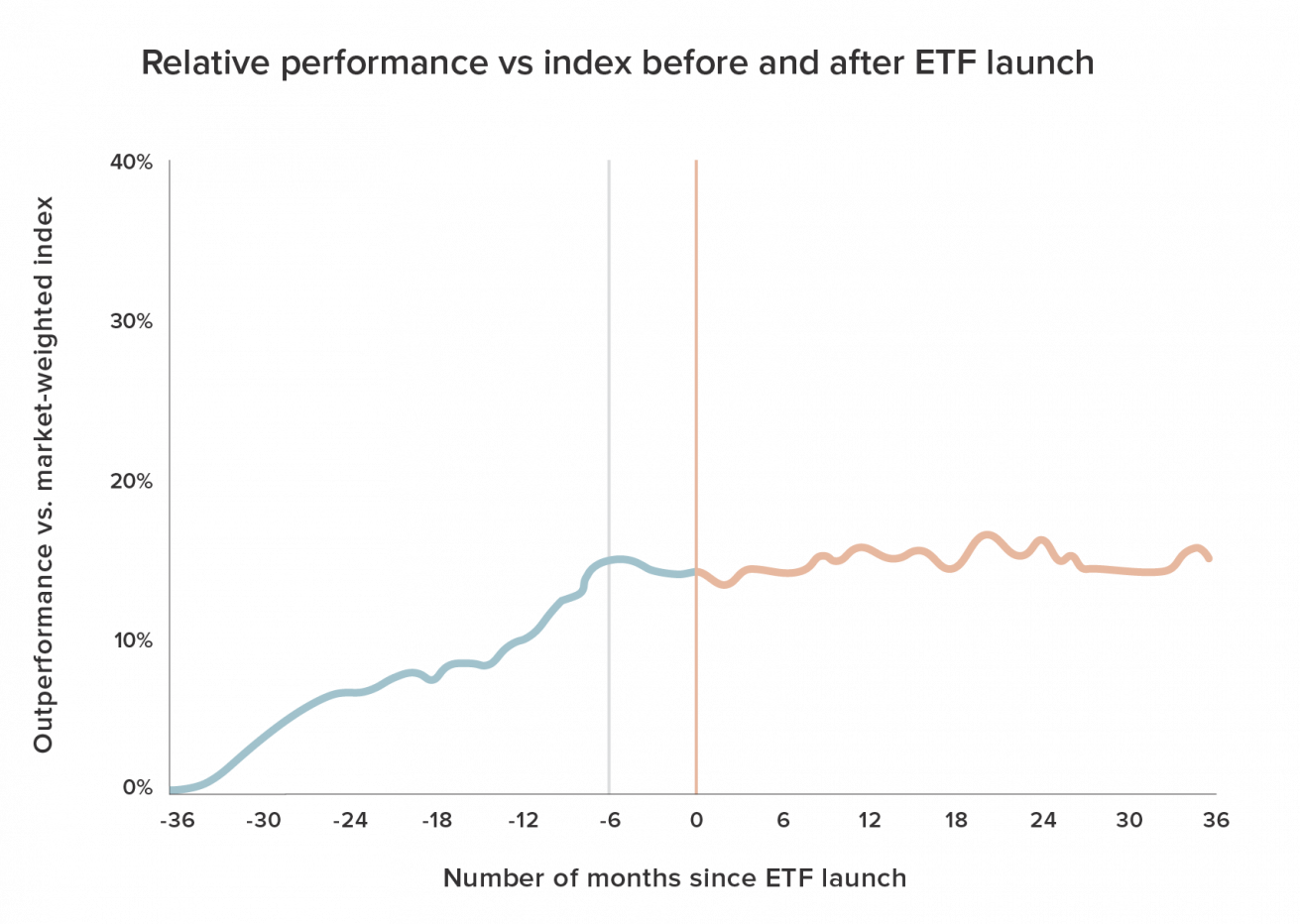

Generally, recently launched ETFs follow themes that have performed well over the short term. The recent positive performance can trick investors into placing bets against future performance. However, like most themes, they tend to mean revert (i.e. return to their long term average), and that can lead to market timing which is extremely hard to get right.

Thematic ETFs: things to be aware of

High fees

Despite their popularity, it costs more to construct a thematic ETF, which in turn, leads to higher fees. The average thematic ETF charges 0.57% per year in fees, which is five times the cost of a broad based share ETF.

Shorter life spans

Thematic ETFs can get terminated if they don’t attract enough money. They’re high-risk/high-reward bets, so it’s up to the investor to limit their exposure to thematic ETFs and focus on less risky, lower cost and more diversified products that focus on all sectors and themes.

Poor performance

Unfortunately, trendy thematic ETFs have lost Australian investors more than $100 million over the past year. ETF issuers can influence investors to chase past historical returns by launching a trendy ETF right at the peak of its interest, which normally attracts retail investor money.

New ETFs: Active funds turning to ETFs

Active fund managers have always been shy of ETFs, preferring to invest via traditional mutual funds or listed investment companies (LICs). However, we have seen these fund managers recently favouring the ETF structure given the liquidity and tax efficient characteristics. 18 active strategies were launched in Australia over the past year, including fund managers such as Magellan, Resolution Capital, Janus Henderson, Fidelity and Australian Ethical.

New ETFs summary table by launch date (March 2021 – March 2022)

| ETF Code | ETF Name | Sector | Fee | Launch Date |

| BHYB | BetaShares Australian Major Bank Hybrids Index ETF | Fixed Income & Cash | 0.35% | Apr’21 |

| IESG | iShares Core MSCI Australia ESG Leaders ETF | Australian Shares (strategies) | 0.09% | Jun’21 |

| MAAT | Monash Absolute Active Trust (Hedge Fund) | Australian Shares (active) | 2.26% | Jun’21 |

| SEMI | ETFS Semiconductor ETF | Global Shares (sectors) | 0.57% | Aug’21 |

| MHHT | Magellan High Conviction Trust (Managed Fund) | Global Shares (active) | 1.50% | Aug’21 |

| GCAP | VanEck Bentham Global Capital Securities Active ETF (Managed Fund) | Fixed Income & Cash | 0.59% | Aug’21 |

| FUTR | Janus Henderson Global Sustainable Active ETF (Managed Fund) | Global Shares (active) | 0.80% | Sep’21 |

| HGEN | ETFS Hydrogen ETF | Global Shares (sectors) | 0.69% | Oct’21 |

| LSGE | Loomis Sayles Global Equity Fund (Quoted Managed Fund) | Global Shares (active) | 0.99% | Oct’21 |

| GIVE | Perpetual Ethical SRI Fund (Managed Fund) | Global Shares (active) | 0.65% | Nov’21 |

| CRYP | BetaShares Crypto Innovators ETF | Global Shares (sectors) | 0.67% | Nov’21 |

| GPEQ | VanEck Global Listed Private Equity ETF | Global Shares (sectors) | 0.92% | Nov’21 |

| DHOF | Daintree Hybrid Opportunities Fund (Managed Fund) | Fixed Income & Cash | 0.75% | Nov’21 |

| AMVE | AllianceBernstein Managed Volatility Equities Fund (MVE Class) | Global Shares (active) | 0.55% | Apr’21 |

| FPAY | Magellan FuturePay | Global Shares (active) | 1.00% | Jun’21 |

| FIXD | Coolabah Active Composite Bond Fund (Hedge Fund) | Fixed Income & Cash | 0.30% | Jun’21 |

| DIGA | Cosmos Global Digital Miners Access ETF | Global Shares (sectors) | 0.90% | Oct’21 |

| FTEC | ETFS Fintech & Blockchain ETF | Global Shares (sectors) | 0.69% | Oct’21 |

| TLRA | Talaria Global Equity Fund (Managed Fund) | Global Shares (active) | 0.02% | Nov’21 |

| TLRH | Talaria Global Equity Fund – Currency Hedged | Global Shares (active) | 0.01% | Nov’21 |

| DRIV | BetaShares Electric Vehicles and Future Mobility ETF | Global Shares (sectors) | 0.67% | Dec’21 |

| IPAY | BetaShares Future of Payments ETF | Global Shares (sectors) | 0.67% | Dec’21 |

| FDEM | Fidelity Global Demographics Fund (Managed Fund) | Global Shares (active) | 0.89% | Dec’21 |

| IDEA | Perpetual Global Innovation Share Fund (Managed Fund) | Global Shares (active) | 1.01% | Dec’21 |

| FATP | Fat Prophets Global High Conviction Hedge Fund | Global Shares (active) | 1.77% | Jan’22 |

| MCCL | Munro Climate Change Leaders Fund (Managed Fund) | Global Shares (active) | 0.90% | Jan’22 |

| GAME | BetaShares Video Games and Esports ETF | Global Shares (sectors) | 0.57% | Feb’22 |

| IBUY | BetaShares Online Retail and E-Commerce ETF | Global Shares (sectors) | 0.67% | Feb’22 |

| MCGG | Munro Concentrated Global Growth Fund (Managed Fund) | Global Shares (active) | 0.70% | Feb’22 |

| RCAP | Resolution Capital Global Property Securities Fund (Managed Fund) | Global Shares (active) | 0.80% | Feb’22 |

| OZBD | BetaShares Australian Composite Bond ETF | Fixed Income & Cash | 0.19% | Feb’22 |

| AEAE | Australian Ethical High Conviction Fund (Managed Fund) | Australian Shares (active) | 0.80% | Feb’22 |

| EDOC | BetaShares Digital Health and Telemedicine ETF | Global Shares (sectors) | 0.67% | Mar’22 |

| JZRO | Janus Henderson Net Zero Active ETF (Managed Fund) | Global Shares (active) | 0.85% | Mar’22 |

| NNUK | Nanuk New World Fund (Managed Fund) | Global Shares (active) | 1.10% | Mar’22 |