Every year, super funds twist their annual performance relative to other funds and to index investing in general.

Often, funds make their returns look better than they really are by creatively defining assets as defensive.

Super funds aren’t required to disclose how they classify their investments – even to ASIC. They also aren’t required to share how each asset has performed or even what it is. This allows funds to play the ratings game without anyone holding them to account.

This can lead to problems, such as the large exposure Hostplus had with their unlisted assets in 2020. Another big industry fund, REST Super, has also raised eyes in the past for their definition of defensive assets.

The issue with classifying investments as defensive when they’re really not, as it is implies a lower level of risk, which in turn becomes very problematic for the investor, as they are being misled and taking levels of risk that may not be appropriate for their situation.

What are defensive assets?

First, let’s discuss defensive assets. ASIC defines these as cash or government bonds, and that is the definition that Stockspot uses. We also classify gold as a defensive asset.

Cash is defensive because when markets fall, it holds its value.

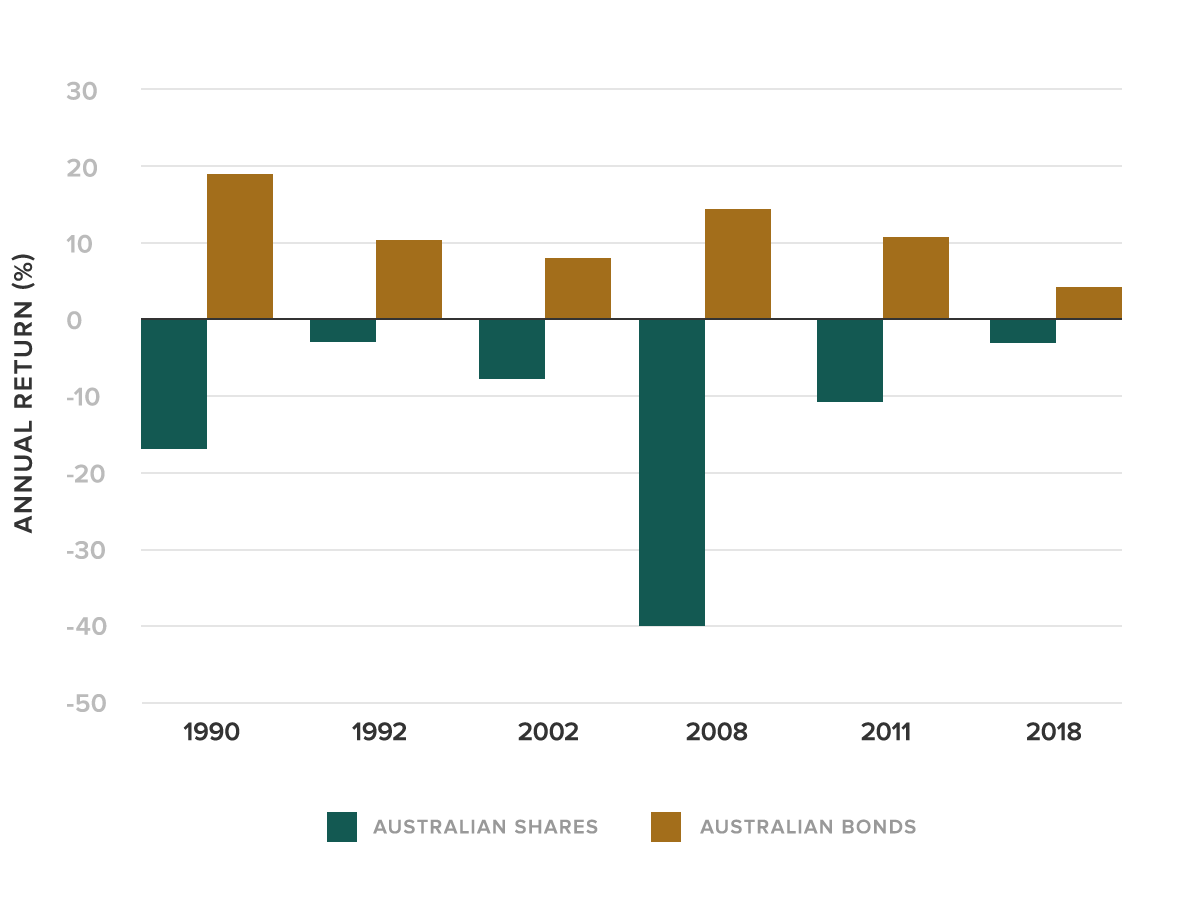

High grade bonds do one better and often rise when share markets fall. History backs this up too; in each of the six times Australian shares had a down year in the past 20, bonds rose to cushion the impact.

Can other assets besides cash and bonds be defensive?

This very much depends on the opinion of the individual fund manager.

High income stream and low growth assets

Just because an asset delivers a high income stream, it doesn’t mean it’s defensive. Take Telstra shares. Most of Telstra’s returns come from regular fully franked dividend income, but the Telstra share price is volatile. This means as an asset its behaviour is not predictable.

Infrastructure and property assets

Often, infrastructure and property are classed as defensive assets. However, a lot of infrastructure and property is held in unlisted vehicles, meaning they don’t trade frequently. This raises three concerns:

- The value of the investment is the opinion of the fund manager and there is no way of knowing whether that value is credible given that there is no open market for the asset.

- The financial structure may see a return of capital reported as income distribution.

- The investment is very illiquid and a sale is often extremely constrained by agreements with co-investors, including first right of refusal and so-called ‘tag-and-drag’ conditions. One critical characteristic of a defensive asset is to be able to sell it in a deep and open market.

The inherently risky nature of infrastructure and property is that they’re usually exposed towards the end of each market cycle when too much debt is loaded in to beef up returns.

In 2008 the Real Estate Investment Trust (REIT) sector fell by a whopping 75% globally because these funds had created income which couldn’t be sustained under high debts and falling prices.

During the Financial Crisis some super funds stopped members from transferring money out because they were unable to sell illiquid unlisted assets. One fund, MTAA super, lost $1.6 billion in 2011 due to poor hedging of unlisted assets. MTAA super lost its spot as one of the best performing funds in 2008 to become the second worst according to Super Ratings.

Gold as a defensive asset

Gold has historically been the purest form of money and acts like a government bond that doesn’t pay interest and protects against inflation (this is known as a zero-coupon inflation protected bond). Throughout the centuries, has been able to maintain its purchasing power and provide portfolio insurance in times of need.

Find out more about gold and whether you should invest in it.

Creative definitions of defensive assets

In recent times many super funds have invented their own definition of a defensive asset which has helped to push them up the ratings.

In 2020, the top performing fund over five years, according to Super Ratings, was the Hostplus default balanced fund which claims a 24% allocation to defensive assets.

The Hostplus website explains that in addition to cash and fixed income “some asset classes, such as infrastructure, property and alternatives may have growth and defensive characteristics”.

Their self-defined defensive assets include infrastructure, credit, property and alternatives. These make up nearly all of the portfolio allocation to defensive assets. Government bonds and cash make up just 5% of the fund.

Historically, regularly claimed top gong in its chosen category. Hostplus isn’t the only one. Many of the top funds have counted some non-defensive assets as defensive so they look like they’re performing above other properly balanced super funds. It pays to check the asset mix of your fund very carefully.

Find out who the top performing balanced super funds are this year.

Is there a reliable super ratings system?

Ratings agencies often don’t properly query the allocations reported by the funds. This provides no check as to the real risk of the self-reported defensive assets.

Of course, the government has recently released the YourSuper tool, but this is not the most reliable or comprehensive tool. That’s because it only compares MySuper options. This is the default offering for members who do not make a specific choice about their super.

The lack of reliable super ratings is why Stockspot publishes the Fat Cat Funds Report every year to shed a light on the best and worst superannuation funds.

Active or indexed super?

Every year, we find out that most actively managed super funds underperform index funds over a five year time frame. Expensive fees for active management is precisely what causes most super funds to underperform. For every active winner there has to be an active loser, and, additionally, management fees drag down net returns.

There are always going to be a small number of funds who beat the index but that group is always changing. Many funds in the top lists this year have also spent time near the bottom when markets weren’t as Many well publicised funds are making some good investments including into venture capital and infrastructure projects that will benefit Australia.

However what shouldn’t be making headlines and driving members to switch is how the fund performed compared to lower risk options in a rising market.

Remember, winners always change – but fees are consistent.

Make sure you compare your super fund with our annual superannuation comparison, the Fat Cat Funds Report.