The growth in the self-managed super fund (SMSF) sector over the past 20 years has been phenomenal. As of 2015 there are 1 million SMSF members who control $550 billion in assets. This represents 50x growth since 1994 when there was only $11 billion in total SMSF assets.

For both young and old Australians, the appeal of having their retirement fate in their own hands is undeniable.

As a group, SMSFs consistently rate the most satisfied superannuation members, citing flexibility, control and the ability to avoid larger funds’ performance problems as key benefits of having a SMSF.

In addition, most studies have estimated that SMSFs as a group have enjoyed similar if not better performance when compared to institutional funds.

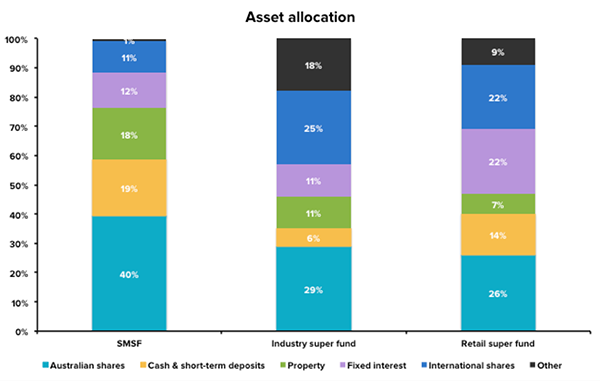

One factor that is more difficult to assess across the SMSF sector is risk. When you compare SMSFs with retail or industry-fund portfolios, they have significantly higher allocations to Australian shares, property and cash with relatively little in fixed interest and global shares.

Source: Multiport, APRA Annual Superannuation Bulletin 2014.

This means that compared to a typical balanced or growth fund, SMSFs have a very different risk profile. Up until recently this asset mix has actually helped SMSFs.

Their high weighting to Australian shares was a blessing during the Australian equity boom of 2003-2007 and from the financial crisis onwards, their high allocation to cash helped to cushion market falls.

However, many SMSFs now face a period of higher risk and potentially poor performance if they don’t address some key risks within their portfolios.

Here are 3 risks that we think SMSFs should consider.

Risk 1: Home country bias

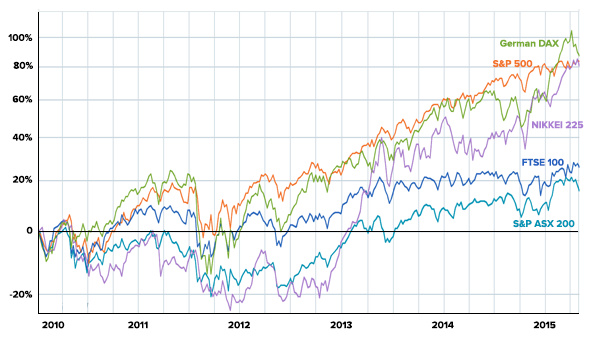

A typical SMSF trustee allocates between 40-45% of their portfolio towards Australian shares. Since 2010, Australian shares have been stuck in a period of underperformance compared to global shares and as a result, many SMSFs have missed out on returns.

This underperformance been magnified by a falling Australian dollar which has boosted unhedged global share returns even further.

There are significant benefits to investing overseas for SMSFs, not only from a returns perspective, but also related to reducing risk via diversification.

Investing overseas allows SMSFs to reduce their risk to individual Australian companies and large sectors such as financials and resources which make up over 50% of the Australian market. It also allows them to access sectors like technology and healthcare which are much more significant overseas.

The Future Fund, which manages $116 billion on behalf of Australians only invests 8.2% of its fund in Australian shares compared to 30.3% of its portfolio into international shares.1 This shows how important global diversification is considered by some of Australia’s smartest investors.

One of the big benefits of investing domestically for SMSFs has been the tax advantages of franking credits – which are particularly attractive to SMSFs in low marginal tax rates. Vanguard estimates that franking credits can add up to 1.5% in returns per year to local investors.

Our model estimates a similar value, which is why Australian shares still make up a large part of our portfolios. However, our portfolios’ international share exposure of 15-25% is much higher than a typical SMSF since the diversification benefits of owning overseas shares are also significant.

Risk 2: Bank and property risk

Investment Trends research data found that the average SMSF holds shares in 18 Australian companies. A large part of this exposure is to a few stocks, namely the big four banks since they now represent 32% of the ASX 300.

Fortunately for SMSFs, banks have enjoyed a period of extraordinary performance buoyed by growing fully franked dividends and falling interest rates.

But this is a trend that has the potential to reverse, particularly if interest rates begin to rise, making bank dividends less attractive. Banks could also be exposed to large loan losses if there were to be a significant fall in residential property prices.

Australia’s banks have around 61% of their loan books exposed to residential property. This means that many SMSFs have essentially ‘doubled up’ on their property exposure by owning direct property as well as bank shares. Additionally, many SMSFs also own bank hybrids and bank bonds. This all adds up to a large direct and indirect property exposure for many SMSFs.

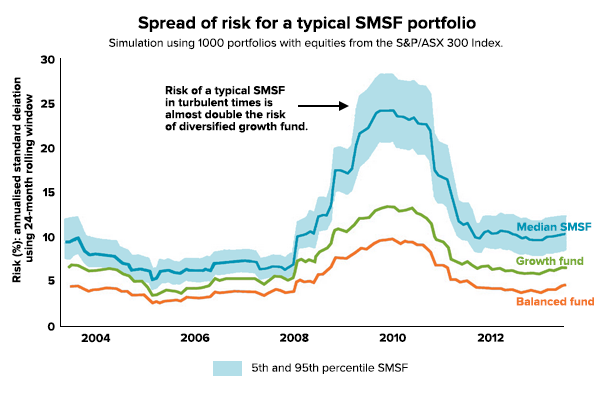

Vanguard estimates that the average SMSF contains about double the risk of a typical growth fund largely due to this high exposure to just a few companies, particularly the banks.

Source: Vanguard, Bloomberg and FactSet

It is important for SMSFs to understand the links and correlations between different investments including bank shares, hybrids and residential property. These correlations could cause much larger risk during periods of market turmoil and can be avoided through better diversification across different sectors, assets and countries.

Risk 3: High cash exposure

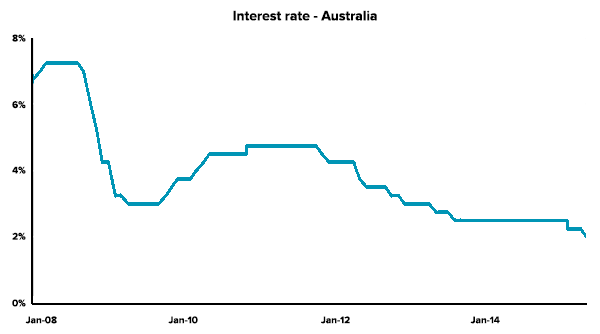

A typical SMSF has allocated 19% of their portfolio into cash and short-term deposits, which paid off handsomely during the financial crisis when share markets suffered heavy falls and banks were still paying 5-6% interest.

Nowadays, interest rates in Australia and around the world have been cut to unprecedented levels and as a result, SMSFs holding high cash balances are suffering with returns closer to 2-3% per year.

Source: Reserve Bank of Australia

Large cash holdings are a drag on returns over the long-term since cash has historically generated lower returns than shares and bonds. In a low interest rate environment SMSFs should be thinking carefully about how much cash they need to be holding and consider other defensive assets like bonds (fixed interest) in their portfolio.

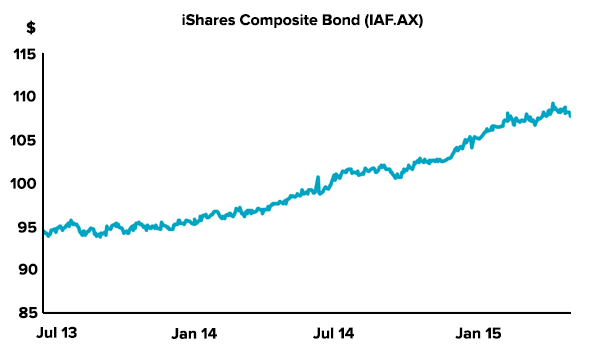

Unlike cash, bonds have the ability to benefit from falling interest rates. Over the 12 months to April 2015 most bond ETFs performed strongly, including IAF in our portfolios which returned 8.40%.

On average, the high cash balances held by SMSF trustees put many at risk of underperforming growth and balanced funds over the long term, particularly during their accumulation stage.

Diversification into other defensive assets like bonds can help to reduce some of this underperformance risk. SMSFs trustees need to consider various factors, including their life stage when deciding what cash allocation is appropriate for them.

What it all means

SMSFs face growing risks in their portfolios due to their high cash balances and over-reliance on Australian shares. In the past, access to other assets like international shares and bonds was difficult for SMSFs trustees but nowadays ETFs provide a simple, cost effective way for SMSFs to diversify their portfolios.

By combining assets in the right way, SMSF trustees have the ability to reduce their portfolio risk without necessarily sacrificing returns thanks to the benefits of better diversification.

Find out how Stockspot makes it easy to grow your wealth and invest in your future.

Note: Past performance of financial products is no assurance of future performance.