Sometimes the weather folk at the Bureau of Meteorology get it wrong and it rains when you least expect it. You’re caught outside in your thongs without an umbrella and frankly, it’s not fun.

That’s why having some money set aside for unexpected events is advice we give to all clients. This is money that should be readily available in a bank savings account rather than invested.

What is an emergency fund?

Also known as an emergency fund or a savings buffer, it’s an amount of money you have saved that can cover the costs of a surprise expense or period without an income.

Having some cash set aside means you don’t need to borrow or dip into your longer term investments if you need money quickly. It gives you breathing space if things go wrong.

And stuff does go wrong…

Life happens and suddenly you have an unexpected expense you need to deal with immediately. Your car might break down, a sports injury could mean knee surgery or worst case scenario you lose your job or a sudden illness might leave you unable to work or needing to care for a relative.

The ability to access cash quickly and easily without dipping into your investment portfolio is a huge relief.

Why shouldn’t I dip into my portfolio. That’s what it’s there for right?

There are a few reasons why you want to avoid borrowing or dipping into investments for emergency cash.

Borrowing is typically very expensive, especially for emergency cash or a personal loan. Interest rates for personal loans start at around 10% (if you’re lucky) and go up from there. Pay-day style loans have been known to charge much higher rates of 50% per year (or more) which will cost you bucket loads in interest and mean you’re spending months or years afterwards paying it off.

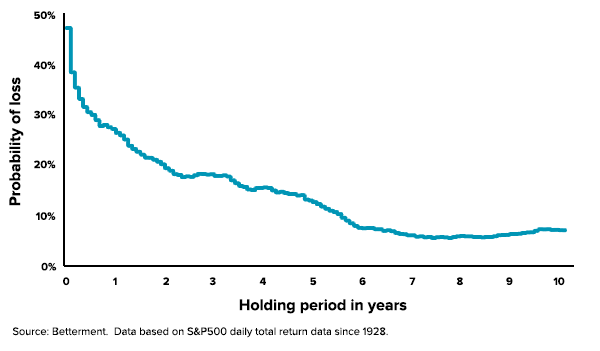

Investments are a less expensive way to fund short term expenses but should be avoided for a different reason. If you dip in and out of your investment portfolio, you expose yourself to a higher risk of selling investments during a market ‘dip’ rather than holding for your planned time-frame. Your chance of losing money reduces with every year you hold investments, selling early means there’s a much higher chance you sell before you make a profit.

If you plan to use your investment portfolio as a pseudo bank account you need to ask yourself if investing is right for you. When the market falls you want to be in a position to add to your portfolio, not sell to cover emergency expenses.

Time in the market rather than timing the market is the key to investment success.

Why we recommend all clients keep a savings buffer

Investing isn’t right for everyone. Quite often we turn potential clients away because we believe they need to pay off high interest debt before investing is a good option for them.

Keeping a cash buffer is one of our top 5 financial tips as we believe it gives clients the best possible chance of reaching their investment goals.

How much do I need for an emergency fund?

As a rule of thumb, we think your rainy day fund should cover your cost of living for at least 3 months. This means you can still afford to live and cover short term expenses without dipping into investments.

For example:

If you spend $1,000 per month on rent/mortgage and $600 on living expenses then your savings buffer would be ($1,000 + $600) x 3 = $4,800. This the minimum amount you should have stashed away in a high interest savings account as a buffer.

If you need to dip into your savings buffer at any point, we encourage clients to replenish it before topping up their investments further.

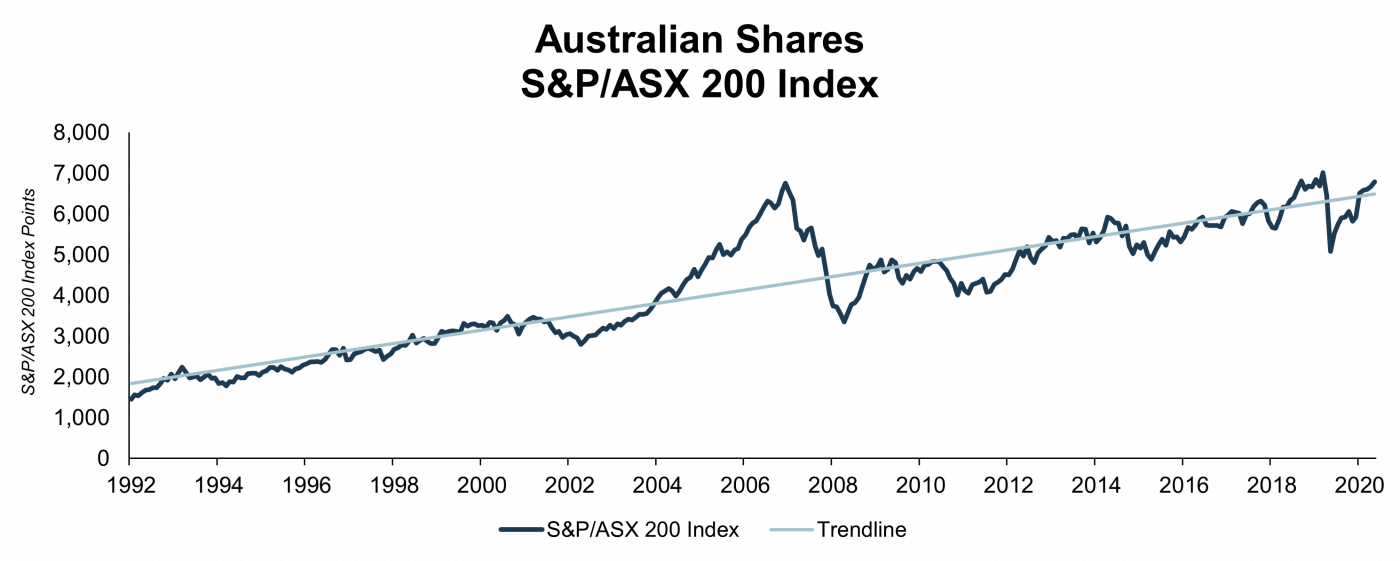

This may seem cautious but if a fall in the market coincides with when you need money you don’t want to have to dip into your investment portfolio at the worst possible time.

Knowing exactly where the market is tracking compared to the long-term trend is impossible.

This is why it’s vital to have an appropriate investment horizon to be able to ride the trend – through good times in your life, and bad. The Stockspot investment calculator can help you calculate your possible returns once you’re ready to invest.

Find out how Stockspot makes it easy to grow your wealth and invest in your future.