Over the past couple of months we’ve received a range of questions from clients related to the heightened market volatility which started mid 2015. Here are some of the common questions our clients have sent us, and our answers for the benefit of everyone.

What’s causing the big market movements January?

Should I wait on the sidelines until markets calm down?

Should I move to a lower risk portfolio when markets are falling?

Some analysts predict the market will have a bad year. What do you think?

How do the Stockspot portfolios guard against losses?

What can I do when markets fall to boost my returns?

What’s causing the big market movements in January?

The issues that we first discussed in our August update have persisted in the market including:

-

Concerns that the Chinese economy is slowing faster than expected – and the impact that is having on their currency

-

A collapsing oil price

-

US rate hike uncertainty.

Like in August, the Stockspot portfolios have benefited from their investments in bonds and gold which are up for the month to date, and have helped to reduce the impact of share market falls. This balancing out of investments is the benefit of a well diversified portfolio.

Should I wait on the sidelines until markets calm down?

Investors have a tendency to sell or stop investing when the market drops out of fear that it will continue falling. This is normal behaviour as people don’t like uncertainty and will try and avoid risk of losses if possible. When markets fall it can feel as if you should be selling and waiting on the sidelines until everything calms down. Recently we have been asked by several clients whether that is a sensible strategy for the current climate.

Since markets are notoriously difficult to predict, trying to time when you should enter and exit is fraught with danger. Studies have shown that investors who try to do this typically earn lower returns than those who just buy and hold. This is because when you try and time the market, you’re more likely to be tricked by your emotions and buy or sell at the wrong time.

Rather than trying to pick your entry and exit points, regularly topping up your portfolio can help ensure that you invest at different parts of the market cycle, so you can take advantage of lower prices when markets fall. Meanwhile, automated rebalancing, which Stockspot is constantly monitoring, will help you buy low and sell high when investments move far from their target portfolio weights.

Risk aversion a topic we discussed in: Retrain your investment brain

Should I move to a lower risk portfolio when markets are falling?

It may not seem like it, but changing your portfolio risk in reaction to market performance is a subliminal form of trying to time the market. Lowering your risk tolerance after markets have fallen results in you selling investments that have fallen the most. This is typically the worst time to be selling those investments. For instance, someone changing from the Stockspot Topaz to Stockspot Amethyst portfolio would be selling Australian shares and buying Australian bonds. Doing this after a market fall would be selling shares relatively low and buying bonds relatively high.

Once you’ve set up your risk profile, we do recommend reviewing it when your circumstances change, however, switching your investment strategy in response to market falls is likely to cost you money over the long-term.

Read more on: What not to do when markets fall

Some analysts predict the market will have a bad year. What do you think?

Stock market strategists are renowned for their alarmist predictions and it can be tempting to let their well-articulated views influence your investment strategy. Sadly, financial news is biased towards these ‘noisy’ commentators who make outlandish predictions that are rarely correct. Don’t forget that their job is to sell research, not make money investing – and research sells best when they have an extreme view.

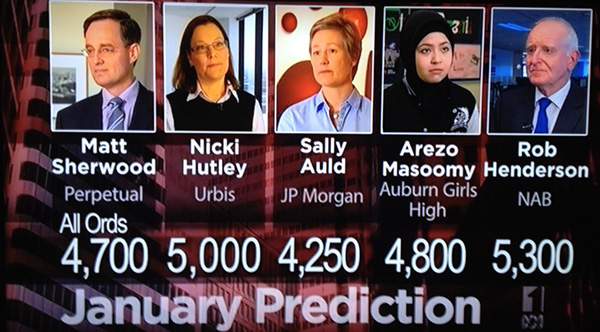

More times than not, market analysts, commentators and strategists get their predictions horribly wrong. For example, here were 5 predictions from the start of 2013 for where the S&P ASX/200 would end the year.

In 2013 the market actually finished the year at 5342, which means that the JP Morgan analyst was wrong by 27%, Perpetual by 14% and the school student beat half the so called ‘experts’.

The reality is that analysts actually have no idea where markets are going, so basing your investment decisions on their predictions is likely to harm your wealth.

Paying attention to market analysts is one of the 6 investment traps to avoid.

How do the Stockspot portfolios guard against losses?

During this period of market volatility, the Stockspot portfolios have benefited from their broad diversification, both across industry sectors as well as asset classes.

For example, one of the most widely held shares in Australia is BHP Billiton, which has halved from $30 to $15 over the past 9 months alone. Over the same period, healthcare company CSL has risen 15%. Since the Stockspot portfolios invest broadly across hundreds of different stocks, you aren’t relying too heavily on any one company in your portfolio and this helps to limit losses and improve the stability of your returns.

Stockspot also invests in defensive assets like bonds and gold, which have risen in January and helped to reduce the impact of share market falls. We recently wrote about how gold helps your portfolio and why bonds belong in your portfolio.

The benefits of these assets have been clear over the first two weeks of January with bonds and gold up 0.2% and 8.5% respectively as share markets fell. Bonds and gold tend to move in the opposite direction of shares and this helps reduce the risk of Stockspot portfolios when share markets fall.

What can I do when markets fall to boost my returns?

When markets are falling, the key is to not fight your natural emotional reactions, but channel them into positive strategies that will improve your long-term returns.

As we discussed in Making the most of market dips, there are some positive actions you can take when markets fall to help your long-term performance. These include;

-

Regular deposits. If you are investing regularly, as many of our clients do, you can take advantage of the market’s dip through dollar-cost averaging, or regular deposits. Automating your investment deposits is the best way to stick to your long-term investment plan and ensure that you avoid the temptation to buy and sell at the wrong times.

-

Take a break from monitoring. If you have a tendency to get nervous when your investments go up and down, consider monitoring your portfolios less frequently. This helps prevent your short-term emotions from overpowering the long-term game plan.

-

Don’t forget dividends. Even though the value of your portfolio might decline over the short-term, it’s likely that you’re still earning returns through dividends and distributions. When markets fall, dividends and distributions can be reinvested at a lower price, helping you benefit even more when markets do recover.

History shows that investors do best when they invest in a well-diversified portfolio, ride out market volatility, periodically rebalance to reduce risk, and top up their balance regularly.

Find out how Stockspot makes it easy to grow your wealth and invest in your future.