In many walks of life we have a tendency to use anchors or reference points to make decisions, and sometimes these lead us astray. Nowhere is this more dangerous than when investing.

What is anchoring?

Anchoring is our tendency to grab hold of irrelevant and often subliminal information in the face of uncertainty to make decisions.

Since anchoring occurs in so many situations, no single theory has conclusively explained why we do it. However the modern favourite theory for explaining the effect of anchoring comes from several groundbreaking studies that were conducted in the fields of decision science and performed by Kahneman and Tversky in the 1970s.

Kahneman and Tversky were interested in how people formed judgements when they were unsure of the facts. They found that when people are uncertain about the correct answer, we take a guess using the most recent number we’ve heard as a starting point.

Various studies have shown that even when people are told that the data they’ve previously heard is wrong or irrelevant, it is still incredibly difficult to avoid factoring it into decisions.

Imagine I told you that the population of Uganda was 2.81 million and then I admitted that I made that number up and actually have no idea how many people live in Uganda but asked you to guess. How many would you guess?

This is the answer.

Would your guess have been closer had I not anchored your estimate with my completely irrelevant 2.81 million?

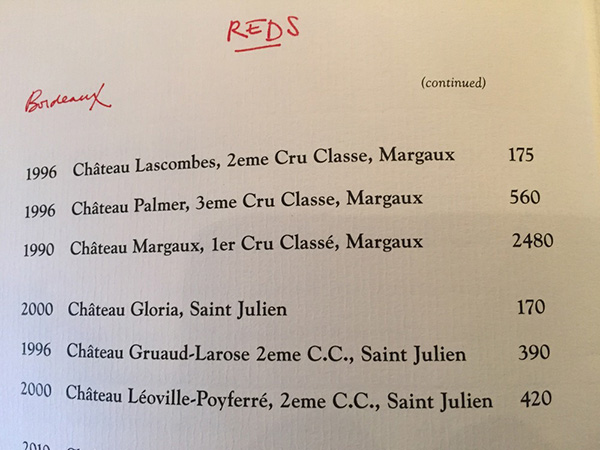

The effects of anchoring have also been shown in consumer behaviour. For example, the price of the most expensive bottle of wine on a menu often serves as an anchor to influence perceptions of other wines on the menu (as relatively cheap).

Similarly, quantity limits (e.g. “limit of 12 bottles per person”) have been shown to increase the amount we purchase.

How or why many investors decide on a buying point or selling price is a bit of a mystery but can often be traced to anchoring.

The classic anchor is a previous price. For instance have you ever heard someone say “I’m waiting for the market to fall back to last weeks/months/years price before I buy” or “I’m waiting for an investment to get back to break-even to sell”. Both of these are examples of investors being tied to irrelevant price anchors.

People anchor to previous price levels because it’s very difficult to know what something is actually ‘worth’ today. This is dangerous because the previous price may have been a ‘fair’ price in the past but todays price is almost certainly the ‘fair’ price for now.

There’s no logical reason to expect a price to return to a historical level, and by anchoring you’re actually more likely to miss out on buying or selling when you should have bought or sold.

Market peaks and low points are other classic anchors. You often hear market commentators discuss how much the market is “up from its lows” or “down from its peak”.

Yet high tide and low tide marks are, by definition, peak events. Why make yourself depressed by benchmarking to a random extreme event when you’ll spend most of the time watching the tide sway in and out?

Historical prices should be irrelevant when deciding whether to make an investment today

There will always be a level in the market that makes you feel great (or terrible) because you didn’t buy or sell at that exact price.

To become a successful investor you need to avoid this hindsight-based line of thinking at all costs. It will only harm your returns and increase your stress levels to play the ‘what if?’ game over and over again in your head.

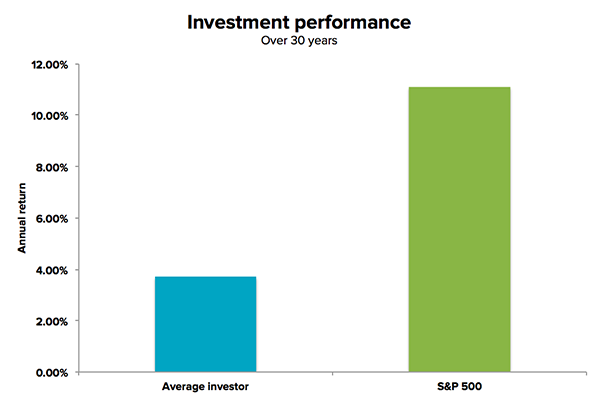

Allowing anchoring to impact investment decisions is one of the reasons why most retail investors earn lower returns than the market over the long run.

The best way to avoid being a culprit of anchoring when investing in broad markets is to ignore the price level altogether, be consistent with making regular investments and disciplined when holding an investment for a planned timeframe.

Over long periods, the effects of buying high or low will average out so only by fighting the urge to pay attention to short term prices will you free yourself from the shackles of anchoring.

Find out how Stockspot makes it easy to grow your wealth and invest in your future.