Placing your eggs in a variety of baskets or spreading your money across many different investments is diversification 101. If there are 2 lessons everyone should be required to learn before they invest they are:

1. How compounding works

2. What is diversification and how does it work.

Why should you diversify and what are the benefits?

There’s no get rich quick – sorry

Picking a winning stock and making a million dollars is an exciting dream that many chase but very few achieve. I say ‘winning’ because that strategy is really just speculation or gambling. The odds are massively against you that you’ll pick a winner and buy and sell at the right time.

There’s a few reasons for this. First, most stocks perform poorly. So picking one or even a few stocks to invest in is likely to result in poor performance and a lot of stress.

Secondly, if you do pick a winner, there’s little chance you’ll have the right timing discipline to buy and sell at exactly the right points. Picking a winning stock and getting your entry and exit points perfect is almost impossible – especially on a consistent basis. That’s why almost all amateurs and even most professionals don’t do well investing in only a few companies. It’s a risky strategy prone for disaster.

Now you’re probably thinking “But I know someone who made a lot of money buying just a few shares?” The problem is you’re more likely to hear about the few success stories than the many who have not succeeded and given up.

The TV makes it easy to believe that picking a few strong companies in your portfolio is easy. Everyone has that friend who has owned Commonwealth Bank shares since they floated for $5.40 in 1991. But for every share that has done well like Commonwealth Bank, there are 10 that have done badly or disappeared. You are being biased by survivorship.

The more likely and common scenario is:

You make a bit of money.

Great!

The market wobbles, you lose money. Not so great =(

You freak, you cut your losses and sell at a loss. You never invest again.

The above experience puts a lot of people off investing and quite rightly. It is a high risk strategy. The mistake these people made was to not diversify their investments.

What is a diversification strategy? (ie: how to put eggs in different baskets)

When you invest you want to reduce the risk of losing money and at the same time boost your opportunity to make a decent return.

Diversification means combining different types of investments to lower the risk of one investment doing badly and impacting overall returns. Spreading your money across lots of investments reduces your need for any particular one to do well.

Instead of hoping one investment will give you the returns you want, you just need investments to do well on average, which is a much more likely prospect.

This is why buying shares in a single company is risky. Buying shares in 2 companies is a bit less risky. Buying shares in 3 companies is… well you get the picture.

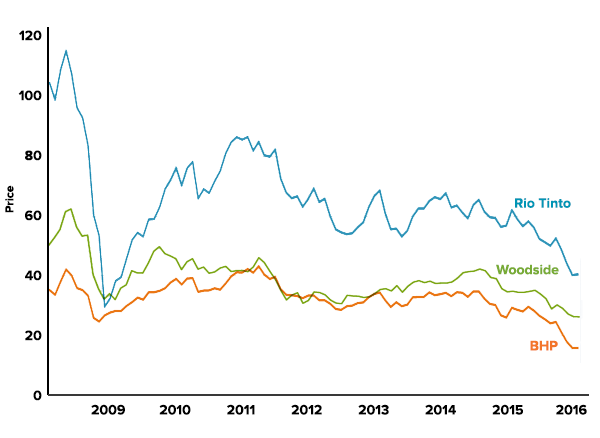

BUT… If you own 3 shares in the same sector (e.g the mining sector), you are still in a high risk investment strategy with very little diversification. If the mining sector falls, like it did in Australia between 2008 and 2016, all the mining companies shares you own will probably head in the same direction.

Generally, if one sector performs badly, another sector is doing well at the same time. If you had owned shares in technology and utilities, the losses made in mining are buffered by gains in the other sectors. This is diversification across market sectors.

Many Australians who just own bank shares, Woolworths, Telstra and BHP don’t have very good diversification across sectors because they’re missing many sectors in their portfolio. Missing sectors means you miss their returns and their ability to buffer your portfolio when other sectors don’t do well.

Diversify across sectors… diversify across markets

Entire markets can fall, meaning almost all companies listed on the ASX (Australian Securities Exchange) can drop in value at once.

Investors still need to put their money somewhere, so when markets fall they rush to place their money in ‘safe havens’ (ie bonds and gold). This is why defensive investments like bonds and gold often do well when shares are falling and why they are important for diversification.

If you own a mix of shares, bonds and gold, your investment portfolio is more insulated. Now you’re not relying on a single sector or a single market to protect you from the storm.

So now you’re thinking…

Crikey, this sounds expensive and crazy complex! I don’t have loads of cash to put in all these different investments or time to workout what to diversify into.

That’s where ETFs come in. It’s easy to diversify with ETFs.

ETFs (exchange traded funds) are a low cost and easy way to build a diversified investment portfolio.

Instead of buying stocks in one company, ETFs buy stocks in all of the companies. For example there is an Australian share ETF, it owns shares in the top 200 companies in the ASX. If you buy this ETF you get access to all of the companies on the ASX.

There is an ETF that owns Australian bonds, instead of buying one bond, you are invested in all the bonds in the Australian bond index. ETFs have made diversification much easier than in the past when you had to buy lots of individual shares.

Stockspot builds diversified investment portfolios using ETFs

Automated investing (or robo-advice) takes diversification one step further. Rather than picking your own ETFs and deciding how much should go into them, we do that for you. That way you don’t need to keep checking what are the best ETFs and how you should divide up your money.

Our portfolios include what we believe to be the 5 most important types of investments for any Australian, giving you diversification across companies, countries and industries across the world.

Our core portfolios all invest in 5 ETFs: Australian shares, global shares, emerging markets, gold and bonds. Each of these investments has its own return profile, so diversifying across them helps smooth out the short-term ups and down in the market and improve your returns.

We decide how your money should be spread across these different investments based on the investment profile you complete when you join. When your goals change, we update how your money is spread. Our team is continually researching the entire ETF universe to decide which ETFs offer the best diversification and can do so at the best cost.

If you’re keen to understand more about how we build our portfolios, read How to build an awesome investment portfolio.

Find out how Stockspot makes it easy to grow your wealth and invest in your future.